What is a Form 1099-K?

We are required to report “payment card transactions,” which have a precise definition in the tax code. The definition includes all credit cards, debit cards and stored-value cards (including gift cards).

Form 1099-K includes sales data for the full calendar year, plus the subtotal for each month of that year. Specifically, we must report gross sales (not adjusting for credits or returns) by the transaction date (not the settle date).

The IRS rules also specify who needs to report payment card transactions. As a general rule, the acquirer or processor that does the settlement of the transactions – meaning the company that puts the deposit into the merchant’s account – is required to report such transactions on Form 1099-K. As a result, Clearent may not report transactions for American Express or Discover accounts where you get a monthly statement directly from Discover, Wright Express or Voyager.

When will I receive my 1099-K?

Each January, we will mail your 1099-K. You should receive it by the end of the month. Your 1099-K will also be posted to Merchant Home at https://my.clearent.net/ui.

What do I do with the 1099-K?

As with all tax matters, you should consult your tax advisor to determine the best approach to complete your income tax returns. Based on the latest available knowledge, the Form 1120 and Form 1040 Schedule C do not have any specific line items to report the amounts from your 1099-K. However, you may need to report sales from credit and debit card transactions as part of the gross sales on your tax return.

To make tax preparation easier, we provide an annual Activity Summary report that includes gross sales, credits, chargebacks and fees. The Activity Summary Report will be posted to Compass each February. We recommend that you provide both the 1099-K and Activity Summary report to your tax advisor or accountant to help them properly complete your tax return.

1099-K Sections

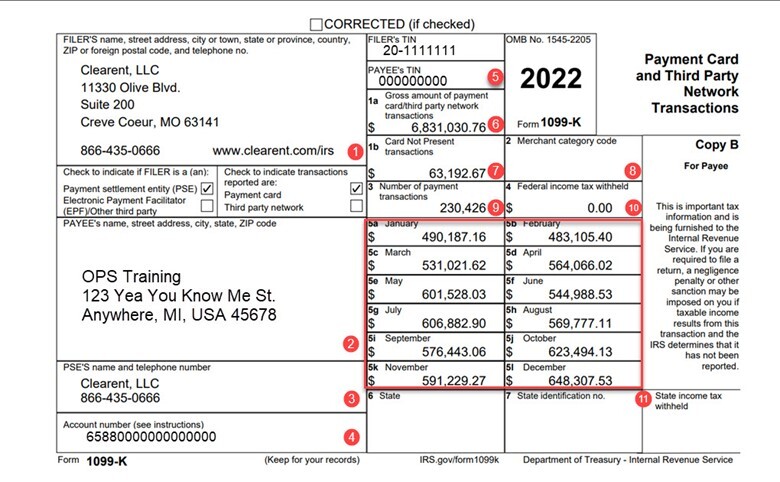

- FILER: Clearent, the merchant’s credit card processor, is responsible for filing this 1099-K to the IRS.

- PAYEE: This is the legal name of the merchant’s business, the taxpayer name used by the IPS that is associated with merchant’s federal tax identification number (TIN).

- PSE: Payment Settlement Entity, the company with whom the merchant has a merchant agreement for credit card processing.

- Account Number: The merchant number for the merchant’s account, also known as the MID or Merchant ID. Even if the merchant has more than one account for the merchant business, the 1099-K lists the account with the highest volume.

- PAYEE’s Taxpayer Identification Number: This is the federal tax number (TIN) for your business according to our records. This is either an Employer Identification Number (EIN) or Social Security Number.

- Box 1a: Includes gross sales for all card types that Xplor Pay settles and deposits into merchant’s account, based on the merchant’s transaction date per IRS requirements. If the merchant receives a separate statement from American Express or Discover, those sales are not included on this 1099-K. (Merchants may receive a separate 1099-K from these card brands)

- Box 1b: The gross amount where the card was not present at the time the transaction or the card number was keyed into the terminal

- Box 2: The Merchant Category Code (MCC) for your account. If the merchant has multiple accounts (MIDs), Clearent selects the MCC with the highest volume.

- Box 3: This required field shows the merchant’s total number of payment transactions and corresponds to the volume reported in Box 1a.

- Box 4: Shows merchant’s Federal income tax withheld (if applicable).

- Boxes 5a-5i: Gross sales for each month of the year. The total of these boxes should match the amount in Box 1.

- Boxes 6-8: Related to state withholding (if applicable).

Accessing Your 1099-K in Merchant Home

To access a 1099-K in Merchant Home follow the steps below:

- Login to Merchant Home at https://my.clearent.net/ui by entering the Username and Password in the boxes provided and clicking the Login button.

- Enter the Merchant’s Business Name or their Merchant ID Number in the search box at the top of the screen.

NOTE: If searching by the Merchant ID only the numbers after the leading zero’s need to be entered. - Select the correct Merchant from the drop-down list.

- Once the dashboard loads select Statements and Tax Forms from the menu on the left hand side.

- Select Tax Documents.

- Select which year and the documents for that year that are needed by clicking inside the box next to the appropriate year/tax document.

- Click the PDF file at the bottom of the screen to open the statement.

FAQs

Why don’t the sales on my 1099-K match my monthly statements?

There are several reasons why the amounts on your 1099-K do not exactly match your monthly statements:

- More than one merchant account with the same Taxpayer Identification Number (TIN), the merchant’s 1099-K includes sales from all of the accounts.

- The IRS requires Clearent to report gross sales on the 1099-K. The merchant’s monthly statement typically reports both gross and net sales, so please make sure the merchant compares the same amounts.

- The IRS requires Clearent to report sales by the transaction date on the 1099-K, whereas the merchant’s monthly statement reports sales by settlement date to align with the deposits in the merchant’s account. However, the merchant can export data by transaction date in New Merchant Home to compare it to the merchant’s 1099-K.

- The 1099-K may not include all card types because the IRS requires Xplor Pay to report only card types that are settled via processor, Clearent (i.e., deposit into your account). If merchant gets a separate statement from American Express or Discover, those sales may be included on the merchant’s Clearent statement, but not on the merchant’s Clearent 1099-K.

Why do you report gross sales on the 1099-K?

The IRS requires that Clearent report gross sales on the 1099-K. The merchant’s business may be able to benefit from potential deductions such as credits (returns), chargebacks and fees when tax return has been filed.

Will I receive a separate 1099-K for each merchant account?

The IRS requires a separate 1099-K for each business that has a unique federal TIN. If the merchant has more than one merchant account, the 1099-K includes sales for all accounts with the same TIN.

What is the Account Number on my 1099-K?

The Account Number is the Merchant Number, MID, given to merchant, that will also show on the merchant’s statement from Clearent. The IRS is focused on the TIN from the merchant’s tax return – not the account number. If the merchant has more than one merchant account with the same TIN, the 1099-K includes the merchant number with the highest sales volume.

How do I know which accounts are included on my 1099-K?

Your 1099-K includes activity from all merchant accounts that share the same TIN, per IRS requirements. The Activity Summary report lists each merchant account associated with your TIN.

What is a Merchant Category Code?

A Merchant Category Code (MCC) is a four-digit number used by the card associations, such as Visa and Mastercard, to classify a business based on the types of goods and services it provides.

How did you pick the MCC on my 1099-K?

When Clearent first set up the merchant’s account, Clearent selects the MCC that best represents the merchant’s business based on card association guidelines. If the merchant’s business has more than one merchant account, the 1099-K includes the MCC for the account with the highest sales volume.

My account is closed. Why did you send me a 1099-K?

The IRS requires Clearent to report all of the merchant’s activity for the calendar year, even if the merchant has closed their account during that year.

My TIN is wrong. How do I fix it?

We used the legal name and TIN that we had on file for your business. If it is incorrect, please help us correct it for you for next year. You can make changes on the Account Settings page in Merchant Home, or you can contact our Customer Support team.

My information is wrong with Clearent but correct with IRS, how do I fix it?

Clearent uses the legal name and TIN on file for the merchant when generating the 1099. If this is incorrect the Merchant needs to be sent a blank W-9 form to update to match what the IRS has on file. The completed form needs to be emailed to Clearent Customer Service at customersupport@clearent.com. Once the form has been received and the information on it has been confirmed, the tax information will be updated, along with the 1099 document.